#Advance Technology Market

Explore tagged Tumblr posts

Text

misc. tech

23/Mar/24

#tech#technology#retro#vintage#cash register#nintendo 64#console#consoles#game console#tv#television#typewriter#atari#atari games#gameboy#super famicom#famicom#gameboy advance#nintendo#ds#3ds xl#3ds#market finds#secondhand#second-hand

9 notes

·

View notes

Text

#1. Global Politics#“2024 US Election”#“Russia Ukraine conflict”#“China Taiwan tensions”#“Israel Palestine ceasefire”#“NATO expansion”#2. Technology & Innovation#“AI advancements”#“Quantum computing breakthroughs”#“ChatGPT updates”#“5G technology”#“Electric vehicles news”#3. Climate & Environment#“Climate change summit”#“Carbon capture technology”#“Wildfires 2024”#“Renewable energy news”#“Green energy investments”#4. Business & Economy#“Stock market news”#“Global inflation rates”#“Cryptocurrency market trends”#“Tech IPOs 2024”#“Supply chain disruptions”#5. Health & Wellness#“COVID-19 variants”#“Mental health awareness”#“Vaccine development”#“Obesity treatment breakthroughs”#“Telemedicine growth”

2 notes

·

View notes

Text

Made this in-character in a recent DnD game. No I will not elaborate further.

#dnd#dnd art#comics#so basically we had to make viral marketing to turn the galaxy against a company we didnt want to pay bills to (Space Company 2) and my cha#racter (Johnny Off-The-Grid) has no understanding of memes or technology so he was not making a joke. hes just so genuinely strange that#everyone thought it was advanced humor anyway and it worked.

9 notes

·

View notes

Text

Introduction to Real Estate Investment Trusts (REITs)

Overview of REITs

An organization that owns, manages, or finances real estate that generates revenue is known as a real estate investment trust, or REIT. Like mutual funds, REITs offer an investment opportunity that enables regular Americans, not just Wall Street, banks, and hedge funds, to profit from valuable real estate. It gives investors access to total returns and dividend-based income, and supports the expansion, thriving, and revitalization of local communities.

Anyone can engage in real estate investment trusts (REITs) in the same manner as they can invest in other industries: by buying individual firm shares, through exchange-traded funds (ETFs), or mutual funds. A REIT’s investors receive a portion of the revenue generated without really having to purchase, operate, or finance real estate. Families with 401(k), IRAs, pension plans, and other investment accounts invested in REITs that comprise about 150 million Americans.

Historical Evolution

1960s - REITs were created

When President Eisenhower passes the REIT Act title found in the 1960 Cigar Excise Tax Extension into law, REITs are established. Congress established REITs to provide a means for all investors to participate in sizable, diversified portfolios of real estate that generate income.

1970s - REITs around the world

In 1969 The Netherlands passes the first piece of European REIT legislation. This is when the real estate investment trusts model started to spread over the world; shortly after, in 1971, listed property trusts were introduced in Australia.

1980s - Competing for capital

1980s saw real estate tax-sheltered partnerships expanding at this time, raising billions of dollars through private placements. Because they were and are set up in a way that prevents tax losses from being "passed through" to REIT shareholders, REITs struggle to compete for capital.

1990s - First REIT reaches $1 billion market cap

In December 1991 the New Plan achieves $1 billion in equity market capitalization, becoming the first publicly traded REIT to do so. Centro Properties Group, based in Australia, purchased New Plan in 2007.

2000s - REITs modernization act

President Clinton signed the REIT Modernization Act of 1999's provisions into law in December 1999 as part of the Ticket to Work and Work Incentives Improvement Act of 1999. The capacity of a REIT to establish one or more taxable real estate investment trusts subsidiaries (TRS) that can provide services to third parties and REIT tenants is one of the other things.

The diverse landscape of REIT investments

Real estate investing is a dynamic field with a wide range of options for those wishing to build wealth and diversify their holdings.

Residential REITs: This is an easy way for novices to get started in real estate investing, as single-family houses offer a strong basis. Purchasing duplexes or apartment buildings can result in steady rental income as well as possible capital growth.

Commercial REITs: This covers activities such as office building investments. They provide steady cash flow and long-term leases, especially in desirable business areas. Rental assets such as shopping centers and retail spaces are lucrative prospects and can appreciate value as long as businesses remain successful.

Specialty REITs: These include investments in healthcare-related properties such as assisted living centers or physician offices. Datacenter investments have become more and more common in the digital age because of the growing need for safe data storage.

Job profiles within REITs

Real estate investment jobs have many specifications, including:

Real estate analysts: The job of a real estate analyst is to find chances for purchasing profitable real estate. These analysts will require a strong skill set in financial modeling in addition to a solid understanding of the current markets. These analysts could also be involved in the negotiation of terms related to pricing and real estate transactions.

Asset managers: Opportunities in property trusts are plenty. The higher-level property management choices are made by asset managers. Since asset managers will be evaluating and controlling a property's operating expenses about its potential for income generation, they must possess a greater foundation in finance.

Property managers: REIT employment prospects include property managers. While some real estate investment trusts employ their property managers, others contract with outside businesses to handle their properties. Along with working with renters, property managers handle all daily duties required to keep up the property.

Essential skills for success in REIT careers

Successful REIT careers require the development of several essential talents, three of which are listed below:

Financial acumen: Jobs in real estate finance involve investors with strong financial acumen who are better equipped to evaluate financing choices, cash flow forecasts, property valuations, and tax consequences. With this thorough insight, investors may make well-informed strategic decisions that optimize profits while also supporting their investing goals.

Market analysis skills: Real estate investors should cultivate an awareness of important market indicators and a keen sense of market conditions. Purchasing and managing profitable rental properties requires an accurate and detailed understanding of a possible market's amenities, dynamics, future potential, and relative risk.

Communication skills: Are a common attribute among successful real estate investors and are often ranked as the most important one. This is because effective interpersonal communication is crucial when investing in real estate. Working directly with a variety of industry professionals, including lenders, agents, property managers, tenants, and many more.

Global perspectives on REITs

International REIT Markets:

The US-based REIT method for real estate investing has been embraced by more than 40 nations and regions, providing access to income-producing real estate assets worldwide for all investors. The simplest and most effective approach for investors to include global listed real estate allocations in their portfolios is through mutual funds and exchange-traded funds.

The listed real estate market is getting more and more international, even if the United States still has the largest market. The allure of the US real estate investment trusts strategy for real estate investing is fueling the expansion. All G7 nations are among the more than forty nations and regions that have REITs today.

Technological innovations in REIT operations

PropTech integration: Real estate investment managers can improve the efficiency of property acquisitions and due diligence procedures, which can lead to more precise assessments, quicker data processing, and better decision-making, all of which improve investment outcomes, by incorporating these PropTech platforms into their workflows.

Data analytics in real estate: Data analytics in real estate enables real estate professionals to make data-driven choices regarding the acquisition, purchase, leasing, or administration of a physical asset. To provide insights that can be put into practice, the process entails compiling all pertinent data from several sources and analyzing it.

Conclusion

REITs have a lot of advantages and disadvantages for professional development. They provide a means of incorporating real estate into an investment portfolio, but they could also produce a bigger dividend than certain other options. Since non-exchange-listed REITs do not trade on stock exchanges, there are certain risks associated with them. Finding the value of a share in a non-traded real estate investment trusts can be challenging, even though the market price of a publicly traded REIT is easily available. Buying shares through a broker allows you to invest in a publicly traded REIT that is listed on a major stock exchange. The bottom line for a REIT is that, in contrast to other real estate firms, it doesn't build properties to resell them.

2 notes

·

View notes

Text

Zero Friction Coatings Market: Charting the Course for Enhanced Performance and Sustainable Solutions

The global zero friction coatings market size is estimated to reach USD 1,346.00 million by 2030 according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.6% from 2022 to 2030. Growth can be attributed to the fact that these coatings reduce friction and wear resulting in low fuel consumption and less heat generation. According to the European Automobile Manufacturers' Association, 79.1 million motor vehicles were produced across the globe in 2021 which was up by 1.3% as compared to 2020. Zero friction coatings can extend the time between component maintenance and replacement, especially for machine parts that are expensive to manufacture.

Zero Friction Coatings Market Report Highlights

In 2021, molybdenum disulfide emerged as the dominant type segment by contributing around 50% of the revenue share. This is attributed to its properties such as low coefficient of friction at high loads, electrical insulation, and wide temperature range

The automobile & transportation was the dominating end-use segment accounting for a revenue share of more than 35% in 2021 due to the rapid growth of the automotive industry across the globe

The energy end-use segment is anticipated to grow at a CAGR of 5.7% in terms of revenue by 2030, owing to the excessive wear on the drill stem assembly and the well casing during the drilling operations in the oil and gas sector

In Asia Pacific, the market is projected to witness the highest CAGR of 5.8% over the predicted years owing to the presence of car manufacturing industries in the countries such as Japan, South Korea, and China

For More Details or Sample Copy please visit link @: Zero Friction Coatings Market Report

Several applications in the automobile industry use wear-resistant plastic seals that require zero tolerance for failure and lifetime service confidence. Increasing demand for the product from the automotive industry across the globe for various applications including fuel pumps, automatic transmissions, oil pumps, braking systems, and others is expected to drive its demand over the forecast period.

Low friction coatings can be used in extreme environments comprising high pressure, temperatures, and vacuums. These coatings can provide improved service life and performance thereby eliminating the need for wet lubricants in environments that require chemicals, heat, or clean room conditions. The product containing molybdenum disulfide (MoS2) are suitable for reinforced plastics while those free from MoS2 are suitable for non-reinforced plastics.

Zero friction coatings are paint-like products containing submicron-sized particles of solid lubricants dispersed through resin blends and solvents. The product can be applied using conventional painting techniques such as dipping, spraying, or brushing. The thickness of the film has a considerable influence on the anti-corrosion properties, coefficient of friction, and service life of the product. Its thickness should be greater than the surface roughness of the mating surfaces.

ZeroFrictionCoatingsMarket #FrictionlessTechnology #CoatingInnovations #IndustrialEfficiency #ZeroFrictionSolutions #AdvancedMaterials #SurfaceCoatings #ManufacturingAdvancements #GlobalIndustryTrends #InnovativeCoatings #PerformanceOptimization #MechanicalSystems #SustainableTechnology #IndustrialApplications #FutureTech #InnovationInMaterials #EfficiencySolutions #ZeroFrictionMarket #TechnologyInnovation #EngineeringMaterials

#Zero Friction Coatings Market#Frictionless Technology#Coating Innovations#Industrial Efficiency#Zero Friction Solutions#Advanced Materials#Surface Coatings#Manufacturing Advancements#Global Industry Trends#Innovative Coatings#Performance Optimization#Mechanical Systems#Sustainable Technology#Industrial Applications#Future Tech#Innovation In Materials#Efficiency Solutions#Zero Friction Market#Technology Innovation#Engineering Materials

2 notes

·

View notes

Text

Renewable energy is becoming increasingly important as the world seeks to reduce its reliance on fossil fuels and transition to a more sustainable energy system. Wave energy, in particular, has gained attention as a potential renewable energy source that can be harnessed from the ocean. In this paper, we will discuss the progress made in testing renewable energy off wave generation in the ocean, how far the technology has advanced, whether wave generation energy is a viable renewable energy source for the future, and how wave generation generates energy.

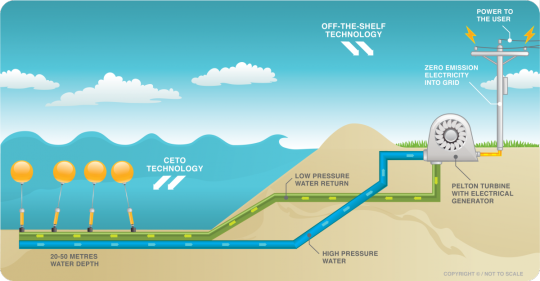

Wave energy refers to the energy that is present in the ocean's waves, which can be converted into electricity. There are different ways of harnessing wave energy, but the most common method involves using a device that captures the kinetic energy of the waves and converts it into electrical power. These devices are typically installed offshore and can be connected to the grid to supply electricity to homes and businesses.

The technology for harnessing wave energy is still in the early stages of development, but there have been significant advances in recent years. There are currently several prototype devices in operation around the world, including the Pelamis, the Wave Dragon, and the Oyster. These devices use different methods for capturing wave energy, but all have the same goal of converting the kinetic energy of the waves into electricity.

The Pelamis is a wave energy converter that consists of several connected cylindrical sections that move in response to wave motion. The movement of the sections drives hydraulic pumps, which in turn drive generators to produce electricity. The Wave Dragon is a floating platform that uses the motion of the waves to drive turbines, which generate electricity. The Oyster is a device that captures the energy of nearshore waves and uses it to pump high-pressure water to an onshore turbine, which generates electricity.

Despite the progress that has been made, wave energy is still not a viable renewable energy source for the future. One of the main challenges of wave energy is that it is an intermittent source of energy. Unlike solar and wind energy, which can be generated consistently throughout the day, wave energy is dependent on the ocean's waves, which are influenced by a variety of factors, including wind, tides, and weather patterns. This makes it difficult to predict and plan for wave energy production, which can make it difficult to integrate into the grid.

Another challenge of wave energy is that the devices used to capture it can be expensive and difficult to maintain. Offshore devices are subject to harsh environmental conditions, including saltwater corrosion and high waves, which can cause wear and tear on the devices. This can result in high maintenance costs, which can make wave energy more expensive than other renewable energy sources, such as solar and wind.

Despite these challenges, there is still significant potential for wave energy as a renewable energy source. According to a report by the US Department of Energy, wave energy has the potential to supply up to 20% of the country's electricity needs by 2050 [[3]]. This potential is due in part to the fact that wave energy is a much denser source of energy than wind, which means that it can generate more electricity per unit of area. Additionally, there are vast areas of the ocean that are suitable for wave energy production, which means that there is significant potential for scaling up the technology.

In conclusion, wave energy is a promising renewable energy source that has the potential to play a significant role in our transition to a more sustainable energy system. While the technology for harnessing wave energy is still in the early stages of development, there have been significant advances in recent years, and there is still significant potential for further development. However, wave energy is still not a viable renewable energy source for the future, due to its intermittent nature and high maintenance costs. Nevertheless, with the right policies and investments, wave energy has the potential to become an important renewable energy producer.

#wave energy converter market#waves#wave energy generation#wave energy production#wave energy#renewable electricity#renewable energy#renewables#green energy#renewablephilosopher#new technology#technology advancements#technology adoption#energy#energy production

6 notes

·

View notes

Text

Am i the only one that constantly thinks about how Zhongli singlehandedly fucked Teyvat's economy because mans wanted to retire?

#not only is mora used to buy shit#but also as a catalyst for alchemy and upgrading weapons and artifacts#mora will run out and alchemical and technological advancements will be put to a halt#market prices will go to shit#zhongli what have you done#i mean id do the same things but it felt like it was a throwaway thought for you when paimon asked you about the mint#genshin impact#zhongli#rex lapis

5 notes

·

View notes

Text

The Power of 3D Photography in Selling Your Home in Monticello

In today’s competitive real estate market, first impressions are everything. 3D photography has become a game-changer for selling homes in Monticello, Indiana, offering buyers a realistic, immersive experience that sets properties apart. This innovative technology provides an edge by showcasing homes in detail, attracting more qualified buyers and speeding up sales.

Benefits of 3D Photography

Enhanced Buyer Engagement 3D tours allow buyers to explore every corner of a home remotely, offering:

An immersive walkthrough experience.

The ability to view floor plans and layouts in detail.

Increased confidence in their buying decision.

Highlight the best aspects of your home with precision, such as:

Custom architectural details.

High-end finishes and design elements.

Unique spaces like basements, attics, or outdoor areas.

Attracting Out-of-Town Buyers For buyers relocating to Monticello, 3D tours eliminate the need for initial in-person visits, making your property more accessible.

How 3D Photography Works

The process involves advanced cameras capturing high-resolution images to create a virtual model. This model is then hosted online, providing buyers with a seamless, interactive tour accessible 24/7.

Increased Marketing Appeal

Real estate listings with 3D photography:

Attract more online views compared to traditional photos.

Stand out on platforms like Zillow, Realtor.com, and social media.

Enhance open house attendance by pre-qualifying genuinely interested buyers.

Click here to read more

#Monticello real estate#home selling tips Monticello#3D home tours Monticello#virtual real estate tours#Monticello property market#selling a home in Monticello#advanced real estate technology

0 notes

Text

#Automated Technology Group#industrial automation#innovation in automation#Industry 4.0#IoT integration#smart robotics#predictive maintenance#green automation#automation solutions#automation in manufacturing#automation trends 2024#sustainable automation#AI in automation#collaborative robots#automation success stories#future of work#advanced automation systems#automation market growth#automation technology#industrial efficiency

0 notes

Text

Advanced Applications of Williams Moving Average in Modern Futures Trading

The Williams Moving Average has evolved into a sophisticated tool used by professional futures traders, algorithmic trading systems, and institutional investors. Its advanced capabilities in trend detection and market timing make it particularly valuable in modern trading environments.

Advanced applications of the WMA include multi-timeframe analysis, volatility adaptation, dynamic support/resistance levels, momentum confirmation, and risk management implementation. These techniques are especially effective in high-volume futures markets, commodity trading, index futures, currency futures, and energy futures.

These sophisticated applications provide more precise entry/exit points, better risk management, reduced false signals, enhanced trend confirmation, and improved overall trading performance.

Advanced WMA Implementation Strategies:

Adaptive Time-Frame System:

Use multiple WMAs of different lengths

Adjust WMA periods based on market volatility

Implement dynamic crossover signals

Create composite trend signals

Volatility-Based Strategy:

Modify WMA length based on ATR

Adjust position sizing with volatility

Implement variable stop-loss levels

Use volatility filters for trade entry

Advanced Automated Implementation:

Code multiple WMA variations

Create adaptive parameter adjustments

Implement machine learning optimization

Develop sophisticated exit strategies

The advanced applications of the Williams Moving Average demonstrate its versatility and continued relevance in today's sophisticated trading landscape. As markets evolve and trading becomes increasingly automated, the ability to implement adaptive and dynamic strategies becomes crucial. The WMA's flexibility in accommodating these advanced applications makes it an invaluable tool for modern traders. By incorporating these sophisticated techniques into automated trading systems, traders can potentially achieve more consistent results while maintaining the ability to adapt to changing market conditions. As technology continues to advance, we can expect to see even more innovative applications of this versatile indicator in futures trading.

#advanced trading#professional trading#algorithmic strategies#sophisticated trading#futures markets#Williams Moving Average#volatility trading#automated systems#machine learning trading#adaptive trading#institutional trading#advanced indicators#algorithmic implementation#trading technology#market timing#risk assessment#quantitative analysis#systematic trading#trading optimization#professional trading strategies#trading automation#market analysis#technical trading#dynamic trading

1 note

·

View note

Text

Advanced Digital Finance and Market Disruptors: How Technology is Shaping the Future of Money and Investing

The world of finance is undergoing a radical transformation. With digital finance evolving at a breakneck pace, traditional models are being reimagined by technologies like blockchain, AI, and decentralized finance (DeFi). These disruptive innovations are setting the stage for a future where money moves faster, investing is more accessible, and financial opportunities are available to more people…

View On WordPress

0 notes

Text

#1. Global Politics#“2024 US Election”#“Russia Ukraine conflict”#“China Taiwan tensions”#“Israel Palestine ceasefire”#“NATO expansion”#2. Technology & Innovation#“AI advancements”#“Quantum computing breakthroughs”#“ChatGPT updates”#“5G technology”#“Electric vehicles news”#3. Climate & Environment#“Climate change summit”#“Carbon capture technology”#“Wildfires 2024”#“Renewable energy news”#“Green energy investments”#4. Business & Economy#“Stock market news”#“Global inflation rates”#“Cryptocurrency market trends”#“Tech IPOs 2024”#“Supply chain disruptions”#5. Health & Wellness#“COVID-19 variants”#“Mental health awareness”#“Vaccine development”#“Obesity treatment breakthroughs”#“Telemedicine growth”

2 notes

·

View notes

Text

Preventive Vaccines: Prioritizing Health Essential Strategies for Aging Gracefully In Market

Preventive Vaccines are recommended during early adulthood between the ages of 19-26. This lifestage often involves leaving home for college, careers, relationships and other lifestyle changes that can impact health risks. The meningococcal conjugate vaccine (MenACWY) is suggested at age 21 to provide protection against types of meningitis, a dangerous infection. The tetanus, diphtheria and pertussis (whooping cough) vaccine (Tdap) is also recommended at this age and later on as protection from these illnesses wanes over time. For adults under age 26, the human papillomavirus (HPV) vaccine is important for preventing cancers and diseases caused by certain strains of HPV. Lifestyle factors and sexual activity patterns make this an especially critical period for HPV vaccination.

Get more insights on, Preventive Vaccines

(https://prachicmi.livepositively.com/preventive-vaccines-empowering-adults-essential-strategies-to-safeguard-your-health-and-prevent-severe-diseases/new=1)

#coherent market insights#Rising Vaccination Demand#Biotechnology and Pharmaceutical Growth#Technological Advancements#High Cost of Vaccine Development#New Vaccine Research and Development

0 notes

Text

Computer course fees vary based on the course type, duration, and level of expertise offered, making it accessible for learners at all stages. From foundational courses covering basic computer skills to advanced programming, graphic design, data science, and cybersecurity programs, the city offers a wide range of options at different price points.

#courses#computer courses in delhi#basic computer course#advance computer courses#advanced technologies#cybersecurity#digital marketing

0 notes

Text

BRICS Summit 2024 in Kazan, Russia: A New Era of Global Cooperation

The 2024 BRICS Summit in Kazan, Russia, marked a significant milestone for the world's leading emerging economies. This blog post delves into the key discussions, outcomes, and implications of this pivotal event. Learn how the BRICS nations are shaping th

Welcome to Haqiqa Global Business‘s blog, your go-to source for the latest insights and developments in the world of global business. Today, we’re diving into the significant outcomes and discussions from the BRICS Summit 2024 in Kazan, Russia. This landmark event has the potential to reshape the global economic and political landscape, offering exciting opportunities for entrepreneurs and…

#BRICS#BRICS Countries latest news and developments#BRICS Plus#BRICS Summit 2024#De-dollarization#Economic Growth#Emerging Economies#Emerging markets#Geopolitical Shifts#Global Cooperation#Global Governance#Global Trade and Investment:#Investment#Kazan Summit#New Development Bank#Sustainable Development#Technological Advancement

0 notes

Text

Nvidia to join Dow Jones Industrial Average, replacing rival chipmaker Intel

CEO of Nvidia, Jensen Huang, speaks during the launch of the supercomputer Gefion, where the new AI supercomputer has been established in collaboration with EIFO and NVIDIA at Vilhelm Lauritzen Terminal in Kastrup, Denmark October 23, 2024. Ritzau Scanpix | Mads Claus Rasmussen | Via Reuters Nvidia is replacing rival chipmaker Intel in the Dow Jones Industrial Average, a shakeup to the blue-chip…

#Advanced Micro Devices Inc#Alphabet Inc#Amazon.com Inc#Apple Inc#Breaking News: Markets#Breaking News: Technology#business news#Dow Inc#Dow Jones Industrial Average#Intel Corp#Meta Platforms Inc#Microsoft Corp#NVIDIA Corp#Sherwin-Williams Co#Walgreens Boots Alliance Inc

0 notes